venmo tax reporting limit

Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K. So even if you made 50K but only had 30 transactions you wouldnt get a 1099-K.

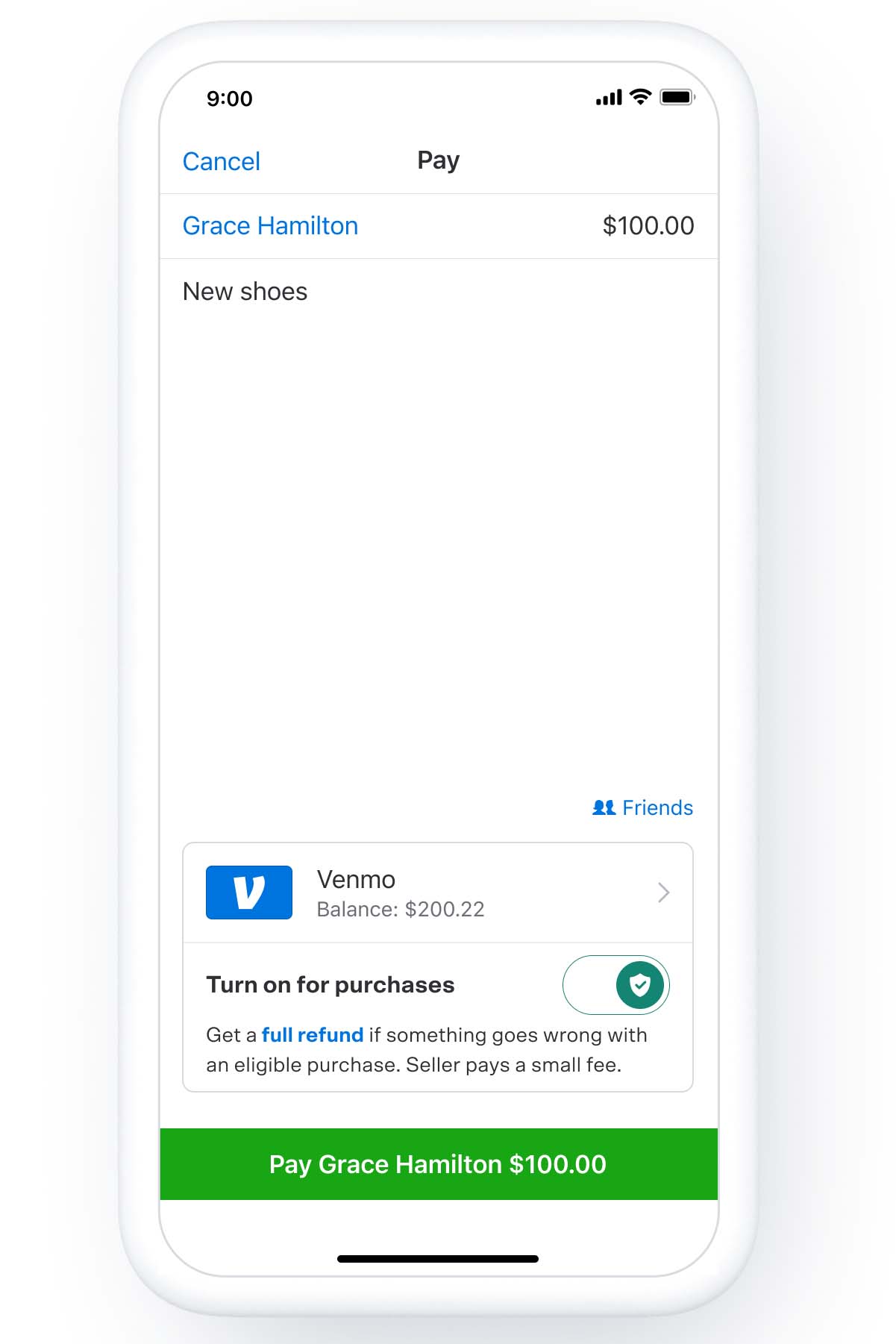

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Thats way bigger than the 600 threshold for most 1099s.

. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. 30 transaction per day this limit resets daily at 1200 AM CST Anticipated reloads on pending Venmo Debit Card purchases and any reloads triggered in the past rolling week count against your limit. Darylann Elmi Getty ImagesiStockphoto.

Beginning with tax year 2022 if someone receives payment for goods and services through a third- party payment network their income will be reported on Form 1099-K if 600 or more was processed as opposed to the current Form 1099-K reporting requirement of 200 transactions and 20000. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Congress updated the rules in the American Rescue Plan Act of 2021.

1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. January 19 2022 504 PM 2 min read. Earlier this year the IRS began requiring US-based peer-to-peer payment apps such as Venmo PayPal and CashApp to report payments received for goods and services of 600 or more a year.

Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS. Sites like Venmo and PayPal now must report business transactions to the IRS when they total 600year. The new reporting requirement only applies to sellers of goods and services not.

Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. The IRS is cracking down on the apps to make sure everyone is paying their fair share of taxes. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business.

Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to report that income on their taxes. While Venmo is required to send this form to qualifying users its worth. Residents of Illinois have a 1000 cap as long as there are more than three payments.

Find your pending and completed purchases by going to the You tab in your Venmo app. This new rule wont affect 2021 federal tax. There has been a flurry of furious cash app users this past week angrily responding to rumors of President Joe Bidens new tax reporting plan requiring taxpayers to.

Dont Believe The Hype Bidens 600 Tax Plan Wont Force You to Report All Venmo Transactions to the IRS. A business transaction is defined as payment. 1099-K Threshold and why it matters Originally there was a large threshold for businesses to receive these.

1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the. The threshold was both 20000 and 200 transactions. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year.

Currently online sellers only received these. Will I have to pay taxes when sending and receiving money on PayPal and Venmo - what exactly is changing. Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a year.

Under the IRS new rules the online payment giants such as Venmo PayPal and Cash App were told to report commercial transactions of 600 or higher starting January 1. AT the start of the New Year business owners using third-party payment processors were forced to report 600 transactions or higher to the IRS. Beginning January 1 2022 the Internal Revenue Service IRS implemented new reporting requirements for payments received for goods and services which will lower the reporting threshold to 600 for the 2022 tax season from 2021s threshold of.

This new rule does not apply to payments received for personal expenses. It does not change what is taxable or deductibleit merely seeks to achieve more honest reporting for companies that do a large percentage of their business on Venmo. If the funds being transferred are for goods or a service the new law simply requires businesses to report those funds exceeding 600 rather than the old 20000 limit.

The IRS still expects taxpayers to report any taxable income they get from a P2P payment platform if they meet these requirements even. Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS.

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed Gobankingrates

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

If Your Business Uses Venmo Read This Now Mobile Law

New Venmo Tax Law Are You Filing Correctly Behindthechair Com

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Tax Code Change Affects Mobile Payment App The Hawk Newspaper

/cloudfront-us-east-1.images.arcpublishing.com/gray/NBWPDCVP3VF6VN44PM3H3EW2AY.JPG)

Tax Reporting Changes Coming For Businesses That Use Third Party Payment Apps

New Rule To Require Irs Tax On Cash App Business Transactions Wbma

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Does The Irs Want To Tax Your Venmo Not Exactly

A Tax Fight Is Brewing Over Irs Plans To Get More Bank Information Npr

Merchants Using Payment Apps Will See 2022 Tax Changes Infintech

If You Use Venmo Paypal Or Other Payment Apps This Tax Rule Change May Affect You Wral Com

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham